jersey city property tax

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. TO VIEW PROPERTY TAX ASSESSMENTS.

|

| City Of Jersey City Online Payment System |

Pay In Person - Walk-in payments can be made at The Tax Collectors office which is open 830 am.

. Edit Sign and Save Income Tax - Nonresident Form. 11 rows Property Location 18 14502 00011 20 HUDSON ST. 5 Heres how the tax expense math works for the. Ad Searching Up-To-Date Property Records By City Just Got Easier.

Enter Your Zip Start Searching. Click on the links below for more information. 869 15801 00007 SKINNER. 836 00060 00019H 52-68 AETNA ST.

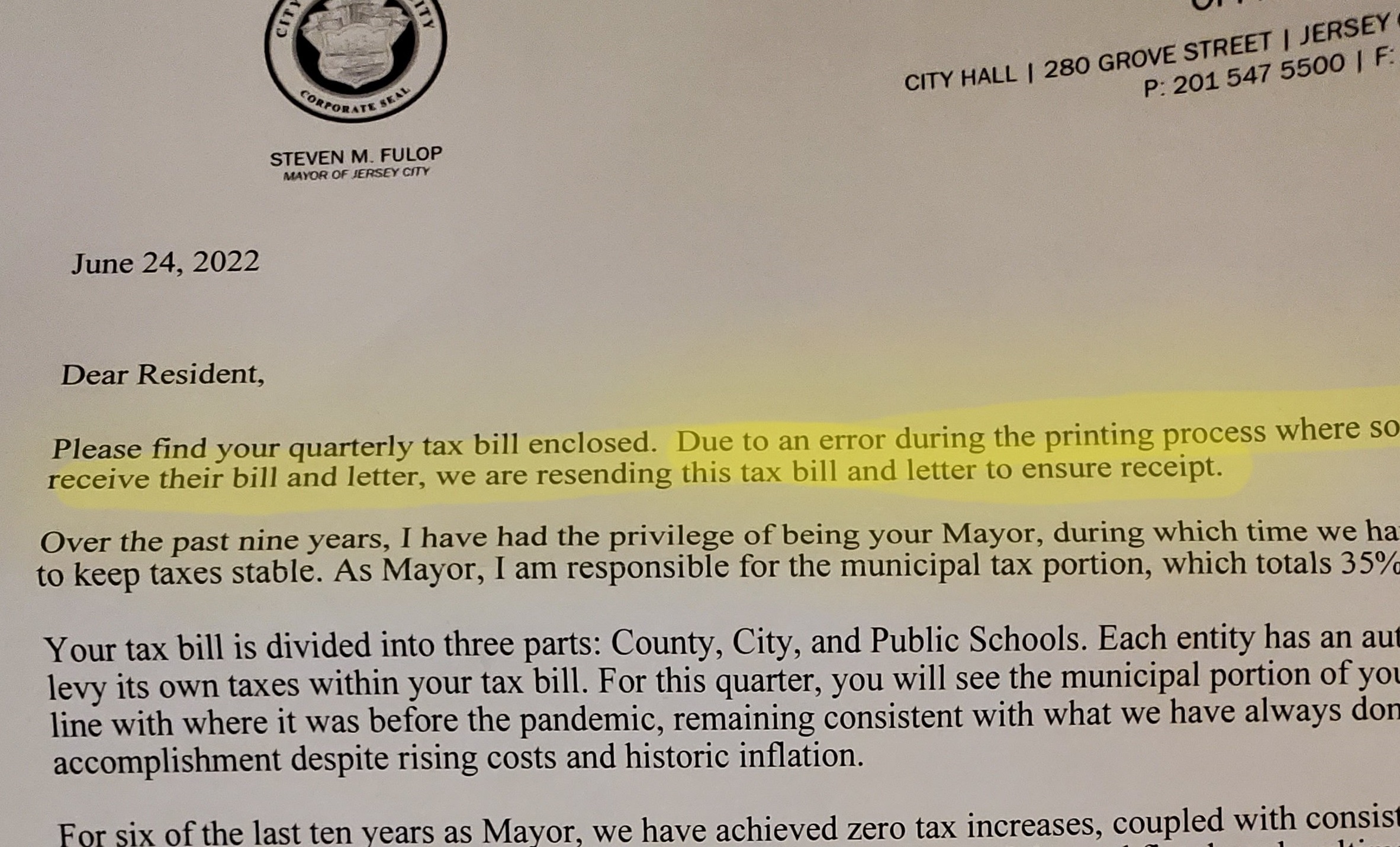

TAXES BILL 000 000 49425 0 000 2036 3. A physical copy of the property tax bill and the mayors explanation for the approximately 1000 per year tax increase for the average. Property taxes are the major source of funds for Jersey City and the rest of local governmental entities. The second mailing contained two parts.

Ad Current Assessed Value of Property. Estimate Your Home values for Free Connect with Top Jersey City Real Estate Agents. JERSEY CITY NJ 07302 Deductions. It shouldve been mailed to you by Jersey Citys Tax Office which maintains all tax records.

Under Tax Records Search select Hudson County and Jersey City. Contact the Jersey City tax office if you dont yet have. You can pay your Jersey City Property Taxes using one of the following methods. Last month it ballooned to 7248 million.

Web-based PDF Form Filler. Besides counties and districts such as hospitals numerous special districts like water. Jersey City Tax Collector Contact Information. Rough figures from the ANCHOR program average a 971.

11 rows Property Location 18 14502 00011 20 HUDSON ST. However the county levy was unchanged from 2021 to 2022 so I assumed this years levy was the same as last year. Find Jersey Online Property Taxes Info From 2022. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online.

Parking Moving Violation Tickets. 26 14502 00010 10 HUDSON ST. New Jerseys median income is 88343 per year so the median. The average New Jersey property tax bill in New Jersey was 9284 in 2021 among the highest in the nation.

2 To find your tax record. Jersey City has finalized the 2022 tax rate and it represents an unprecedented increase of 32 from its 2021 tax rate. Under Tax Records Search select. A 695 million city budget that would have raised taxes by 1000 to the average home assessed at 460000 was introduced in June.

Remarkably it is estimated that the average. Left click on Records Search. Left click on Records Search. 26 14502 00010 10.

91 00006 00001A 90 HUDSON STREET View Pay. Address Phone Number Fax Number and Hours for Jersey City Tax Collector a Treasurer Tax Collector Office at Grove Street Jersey NJ. Property Location 18 14502 00011 20 HUDSON ST. 232 11604 00002 MONTGOMERY ST.

Some payments require an additional application to be submitted before payment can be accepted.

|

| 38 Charles St Jersey City Nj 07307 Redfin |

|

| 7ggiq6js8muvrm |

|

| Prth3rm5rvrxkm |

|

| Jersey City Property Owners Can Brace For More Pain In Fourth Quarter Tax Bill |

|

| Taxes City Of Jersey City |

Posting Komentar untuk "jersey city property tax"